What are the finance options to go solar?

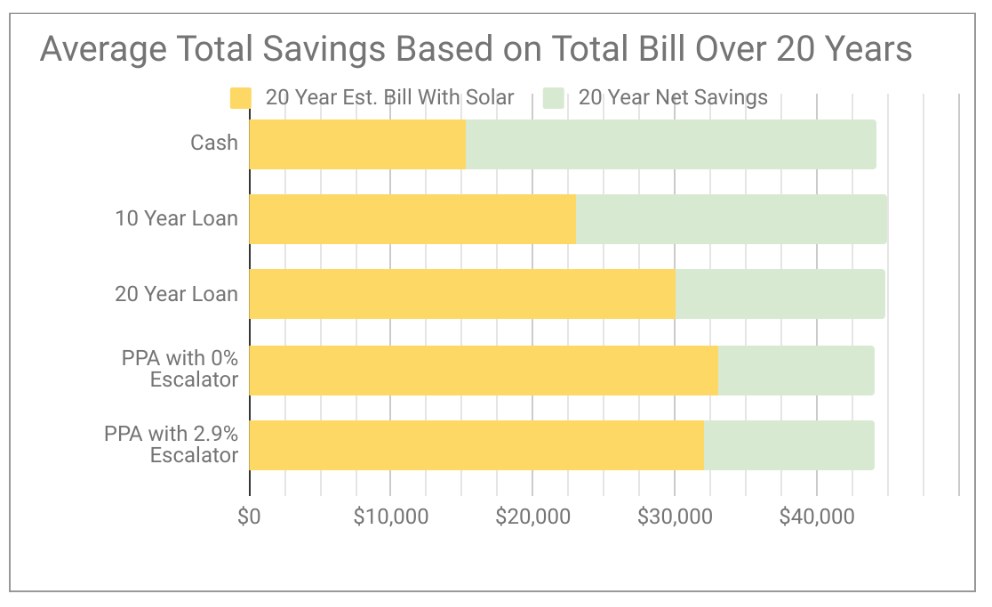

There are a few different ways that an individual can finance their solar system. Financing solar is cost-effective immediately and in the long-run with each of the different options having its own unique benefits. The best way, as is usually the case, is simply using cash, but for many, that isn’t an option leaving the need for other financing options.

All The Different Ways to Go Solar

| Cash | Loan | PPA/Lease | |

| Owner | purchaser | purchaser | solar company |

| Potential Savings | best | great | good |

| Solar Tax Credit (ITC) | keep | pay towards loan (or keep) | solar company |

| Payback | 6 to 10 years* | immediate monthly savings | Immediate rate savings |

| Cost | price of the system and install | pay loan payments | pay solar company fixed or escalator rates |

| Agreement Length | n/a | 8-20 years | 20 years |

| After Agreement | n/a | no monthly payments | option to purchase system* |

| Upkeep | purchaser (minus warranties) | purchaser (minus warranties) | solar company |

*Generally true depending on solar company and utility plan policy and plans.

Cash

Cash is king! Cash is great because it typically saves you the most money of any way to go solar. Because you are purchasing the system outright you own the system and immediately benefit by reducing your electric utility bill to near zero. One benefit of owning the system is that you are eligible for the 30% tax credit (while it’s available). Best of all because you pay one singular payment, the system typically will pay for itself in 6 to 10 years*.

Solar Loan

Solar loans are a great financing option for the solar shoppers who lack the capital for a cash purchase but still want to maximize savings out of a solar energy system and own it. A solar loan usually has options between an 8 to 20-year long payback period, that is often transferable to a new homeowner if need be. With a solar loan, you own the system and can take advantage of the current 30% solar tax credit (while available).

Solar loans allow you to save anywhere from 40% to 70% over the lifetime of the loan agreement and offer immediate returns by saving you money on your electricity bills right away, even as you pay back the loan. You can receive a solar loan at many institutions including traditional banks, solar panel manufacturers, credit unions, national lending institutions, public-private partnerships, utilities, and municipalities.

Power Purchase Agreement (PPA)/ Lease

A PPA/lease is the other solar finance option available. In a PPA/lease, you “rent” the system from a solar company that entitles you to the benefits of the system under the terms of a contract. Solar leases are generally offered for a 20 year period. The PPA/lease are typically marketed as no money down free solar solution which isn’t technically true, you are still paying for power but at a lower rate than utility providers.

- So what is the difference between a PPA and a lease?

- A lease and a PPA is essentially the same except in how the payment is calculated and paid. In a lease, you have a fixed rental fee rate based an agreed upon rate for the production. For a PPA you are paying for the power produced by the system at an agreed-upon rate. Often the option to buy the panel is available if the homeowner so chooses.

Because the solar panels are owned by a solar company you as the homeowner do not receive the financial incentives of owning the system. Fortunately, this cost is usually factored into the rate at which you will lease the system. Another advantage of not owning the system is that the solar company is responsible for upkeep and maintenance. Another benefit is the versatility of choosing between a fixed rate or escalating rates up to 2.99% a year.

The monthly payments for most solar leases increase at a predetermined rate of 1-3% yearly, while solar loans typically have fixed monthly payments. The monthly payments for a 20-year solar loan are likely to be lower than those of a 20-year solar lease.

Solar Financing Considerations

Solar energy system owners are eligible for a solar investment tax credit (ITC) of 30% of the cost of their system at installation. Many states also have additional rebates and incentives like solar renewable energy certificates (SREC’s are mainly on the east coast). These are only available to the owner of the system. See our Solar Recipes page for more incentive information

Solar loans and solar leases/PPA’s both result in immediate savings, with no money out-of-pocket, because your monthly payments will be less than your current monthly utility bill. The monthly savings from a solar loan are likely to be higher than the savings from a solar lease because loans are typically paid off in a shorter time span than the leases. The best savings, if immediately affordable, is to use cash as it there will be no interest or monthly payments.

The amount you are able to pay each month will impact the interest rate and length of the loans. Long-term loans have smaller monthly payments but are paired with larger interest payments over the lifetime of the loan. Shorter-term loans may exceed your monthly utility bill savings, but offer better value as you pay less interest over the lifetime of the loan.